Have you ever opened your banking app, looked at your credit card account, and wondered, “What exactly is available credit? Why is it different from my credit limit?”

You’re not alone — most people see these numbers every month but aren’t sure how they work. I remember checking my card during a vacation, thinking I had more money than I actually did… until I noticed the “available credit” section. That’s when it clicked: available credit isn’t the same as your credit limit.

If you’re confused too, don’t worry — this guide explains exactly what available credit means, how banks calculate it, why it matters, and how to use it wisely.

🧠 What Does Available Credit Mean?

Available credit is the amount of money you can still spend on your credit card before reaching your limit.

Formula:

Available Credit = Credit Limit – Current Balance – Pending Charges

✔ Example Sentence:

“My credit limit is $3,000, but I’ve spent $1,200, so my available credit is $1,800.”

⭐ In short:

Available credit = the remaining money you can borrow on your card.

This number changes every time you:

- make a purchase

- pay your bill

- incur fees

- have pending transactions

📌 Why Available Credit Matters

Available credit affects much more than how much you can spend:

✔ Your credit score

Using too much of your card lowers your score because it affects credit utilization.

✔ Buying power

It tells you how much you can realistically spend today.

✔ Emergency funds

Higher available credit = more financial flexibility.

✔ Approval for future loans

Lenders look at how responsibly you manage available credit.

📱 Where the Term “Available Credit” Is Commonly Used

You’ll see “available credit” in:

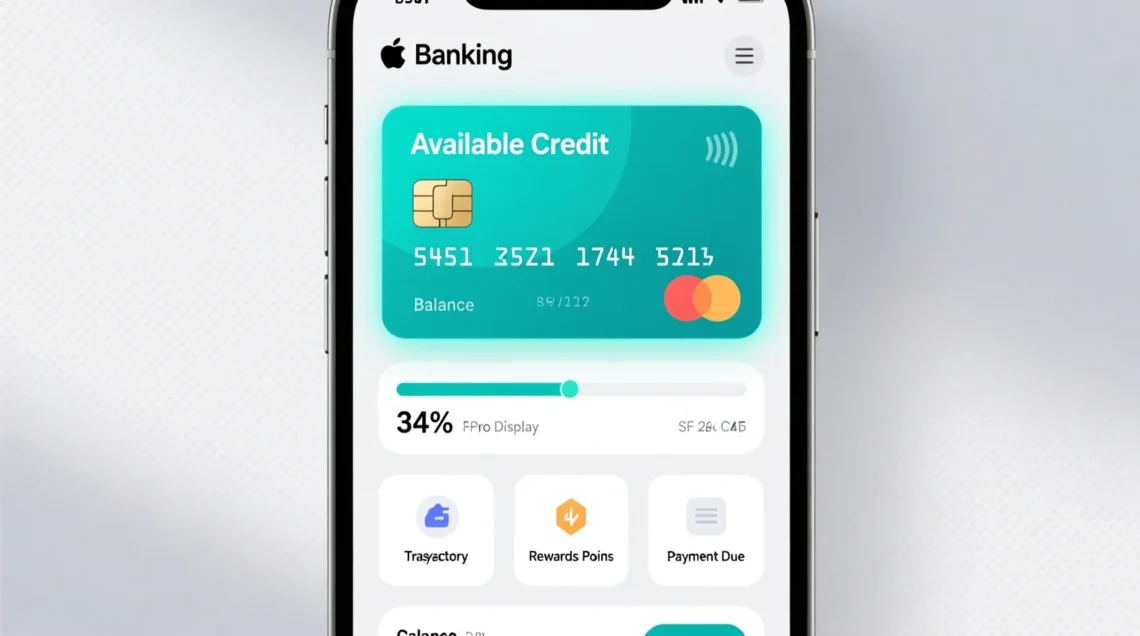

💳 Banking apps

- Credit card summaries

- Statement dashboards

- Transaction updates

🧾 Monthly statements

- Billing cycles

- Interest calculations

📊 Financial tools

- Budgeting apps

- Credit score apps

- Loan applications

🏦 Bank websites

- Help pages

- FAQ sections

- Spending limits

Tone:

Formal, financial, and professional — unlike slang terms.

💬 Examples of “Available Credit” in Real Conversations

1

A: why can’t i buy this online?

B: check your available credit, maybe you’re maxed out.

2

A: I thought I had $500 left.

B: that was your limit, not your available credit.

3

A: my available credit increased!

B: that’s good — means you paid off your balance.

4

A: why did my available credit drop?

B: pending charges reduce it temporarily.

5

A: is low available credit bad?

B: yea, it can affect your credit score.

6

A: should I use all my available credit?

B: no bro, try staying below 30%.

7

A: my card says available credit 0

B: that means you’re maxed out.

🕓 When to Use and NOT Use the Term “Available Credit”

✅ Use it when:

- Talking to your bank

- Reviewing statements

- Managing your card balance

- Asking about spending limits

- Applying for loans or mortgages

❌ Don’t use it when:

- Talking about debit cards

- Discussing cash in your bank account

- Referring to credit score directly

- Talking about prepaid cards

- Using slang or casual terms

📊 Comparison Table: Credit Limit vs Available Credit

| Term | Meaning | Example |

|---|---|---|

| Credit Limit | Maximum amount you can borrow | Limit = $5,000 |

| Available Credit | Amount left to spend | Available = $2,500 |

| Current Balance | What you owe right now | Balance = $2,500 |

| Pending Transactions | Purchases not yet posted | $100 hold reduces available credit |

📈 How Banks Calculate Available Credit

Available credit changes based on:

1️⃣ Your current card balance

Lower balance = higher available credit.

2️⃣ Pending charges

Hotels, car rentals, gas stations put temporary holds.

3️⃣ Payments you made

Payments increase available credit once processed.

4️⃣ Interest & fees

Late fees reduce available credit.

5️⃣ Refunds or credits

Refunds increase available credit.

6️⃣ Credit limit increases or decreases

Banks sometimes adjust limits automatically.

⚡ Common Misconceptions About Available Credit

❌ “Available credit is free money.”

No — it’s borrowed money you must repay.

❌ “All pending charges disappear instantly.”

Some holds last 3–7 days.

❌ “My available credit equals my card limit.”

Only if your balance is $0.

❌ “Using all available credit is fine.”

High utilization hurts your credit score.

❌ “Credit card companies want you to max out.”

No — they prefer low-risk borrowers.

🔄 Similar Financial Terms (and what they really mean)

| Term | Meaning | Difference |

|---|---|---|

| Credit Limit | Max borrowing amount | Fixed number |

| Current Balance | What you owe now | Changes daily |

| Statement Balance | Amount owed for the last cycle | Used for minimum payment |

| Credit Utilization | % of credit used | Impacts credit score |

| Cash Advance Limit | Max amount for cash withdrawal | Usually lower than credit limit |

🙋 FAQs

1. Is available credit the same as my credit limit?

No. Available credit is what’s left after spending.

2. Does available credit affect my credit score?

Yes — low available credit increases utilization, which lowers your score.

3. Why is my available credit lower than it should be?

Pending charges or fees might be holding it temporarily.

4. How do I increase available credit?

- Pay off your balance

- Request a credit limit increase

- Avoid unnecessary purchases

5. Can available credit go negative?

Yes — if fees or interest push your balance beyond your limit.

6. Does available credit reset monthly?

No. It changes only when you spend or pay.

7. Is it good to keep available credit high?

Yes — ideally above 70–80%.

📝 Mini Quiz — Test Your Understanding!

1. Available credit is:

a) free money

b) money left to borrow ✔

c) your income

2. If your limit is $2,000 and balance is $500, available credit is:

a) $1,500 ✔

b) $500

c) $2,000

3. Does using too much available credit hurt your score?

a) yes ✔

b) no

4. Pending transactions:

a) increase available credit

b) reduce available credit ✔

5. Available credit updates:

a) once a month

b) only on weekends

c) every time you spend or pay ✔

📝 Conclusion

Available credit is one of the most important parts of understanding your credit card. It tells you how much you can still spend, how financially flexible you are, and how your credit score might be affected. By keeping your available credit high and your balance low, you protect your credit score and your financial health.

Understanding available credit = smarter spending + stronger credit profile.